Top 5 Best Leading Indicators For Day Trading

A majority of all new traders lose money, so having an accurate trading indicator and a systematic strategy cannot be underestimated when it comes to the process of trading. One way you may choose to not fall into the over-optimizing trap is to simply use the standard settings for all trading indicators. This ensures you are not zeroing in on the most effective setting for the market of today without regard for tomorrow. The most important indicator is one that fits your strategy.

This way, you can easily predict the future price of the security for trading. Sentiment indicators focus on the number of trades and traders to show the position of trades and traders in a particular currency pair. Day trading is a very skillful task for traders, and if you are not good at it, you will incur losses. And that is why you need the most accurate intraday trading indicators. The goal of every short-term trader is to determine the direction of a given asset’s momentum and to attempt to profit from it. There have been hundreds of technical indicators and oscillators developed for this specific purpose, and this article has provided a handful that you can start trying out.

RSI

They became popular once traders on the floor exchanges began to use them. A pivot point is a price at which the direction of price movement changes. The most significant disadvantage of the indicator is that it relies heavily on trends. So other trading signals may not appear or may appear late.

It is also a great practice to combine different indicators. The OBV is also used to signal when institutional and retail investors are present on the market and distinguish the volume generated by either group. Large-scale investors use the VWAP to time moments to get in and out of a trade with as little effect on the market as possible. Our content is packed with the essential knowledge that’s needed to help you to become a successful trader. In other words, a huge demand can very quickly move the price of a stock, and you want to capitalize on this. Next, the 9-day EMA or signal line is plotted on top of the MACD, functioning as a buy and sell trigger.

What is Volume+ (RVOL by time of day)?

This movement suggests that the momentum in the stock price may be fading and that there may be a reversal soon so that the trader is ready to look for short positions. Also, note that divergence can be identified with RSI as well. The overbought and oversold levels are typically configured as 70 and 30, respectively.

You may end up sticking with, say, four that are evergreen, or you may switch off, depending on the asset you’re trading or the market conditions of the day. The Stochastic Oscillator is a great tool to determine the momentum of a security. For traders, it gives an excellent accuracy for buying and selling of trades. You can consider the trend to be strong when the ADX is more than 25. ADX is a popular technical indicator that helps traders to understand trend strength – many different markets use this indicator.

Exponential Moving Average – EMA

Candlestick pattern recognition systems can help you identify candlestick patterns of your choice automatically and highlight the identified patterns on price charts. A reversal becomes more likely when it appears at a support zone, for instance, at VWAP or in an oversold market. What we really care about is helping you, and seeing you succeed as a trader. We want the everyday person to get the kind of training in the stock market we would have wanted when we started out.

Day trading guide for today: Five buy or sell stocks for Friday- May 26 Mint – Mint

Day trading guide for today: Five buy or sell stocks for Friday- May 26 Mint.

Posted: Fri, 26 May 2023 07:00:00 GMT [source]

You don’t need to use all of them, rather pick a few that you find helpful in making better trading decisions. Learn more about how these indicators work and how they can help you day trade successfully. Whichever combination of indicators you choose to use, make sure you’re testing the results and always refining your strategy as you receive more and more data. The Auto Trend Line indicator https://forexhero.info/simple-trading-strategies/ does exactly what its name says, automatically spotting and drawing trend lines directly onto your MT4 charts. They play an important role in drawing support/resistance levels that are being watched by the most number of eyes. Day traders are able to potentially enter a trade at the very beginning of a price move and therefore take a larger profit by riding the entire move.

How to Deal and Overcome Burnout in The Markets

VWAP is behaves as a moving average indicator that is weighted for volume opposed to being calculated as a simple average (SMA) or an exponential function (EMA). The best indicator for day trading will depend on the individual’s specific trading strategies and asset class. Researching and testing different indicators is essential to find the ones that work best for your trading style and goals. Some brokers may offer proprietary indicators or tools that’ll be helpful in your analysis.

- Looking at which side of zero the indicator is on aids in determining which signals to follow.

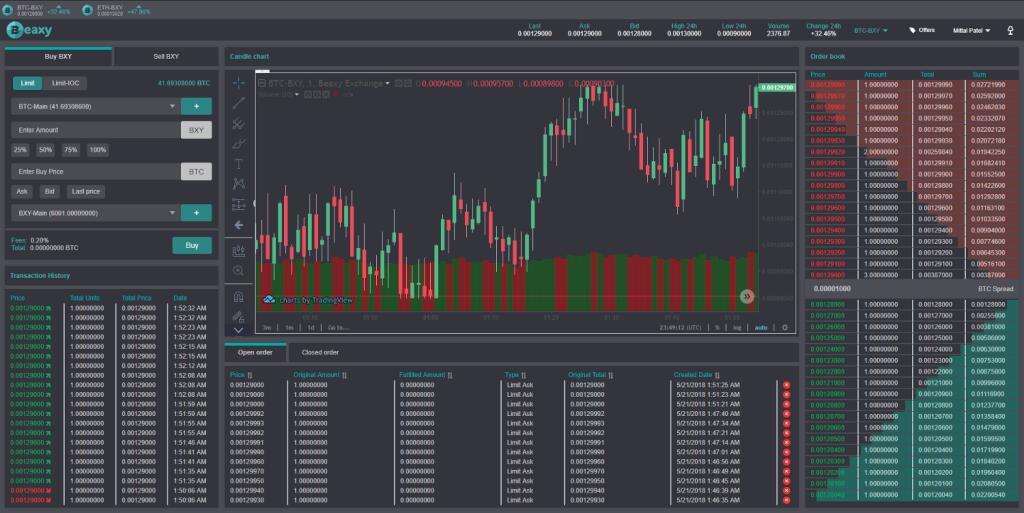

- With TradingView, you can discover investment ideas and share your thoughts with a large and active community of traders.

- As its name suggests, the momentum indicator uses the volume flow.

- After crossing the neutral line, the two lines must remain there during a bullish trend.

Traditionally, a reading above 70 indicates overbought ad below 30 oversold. VWAP is a day trade indicator whose acronym stands for Volume Weighted Average Price. VWAP is growing in popularity as a leading indicator because it does not lag as moving averages. A. The moving average is used primarily to help visualize the trend of a stock.